404

but before you go...

If We Could Help You Get Just ONE New Client Per Month, For $97/mo, Would You Take That Offer?

From The Desk Of Dan Henry

Escazu, Costa Rica

This page will take 5 mins to read and only 1 minute to make a decision.

I’m going to describe what Get Clients University is, what it’s about and then you can decide if you want to join.

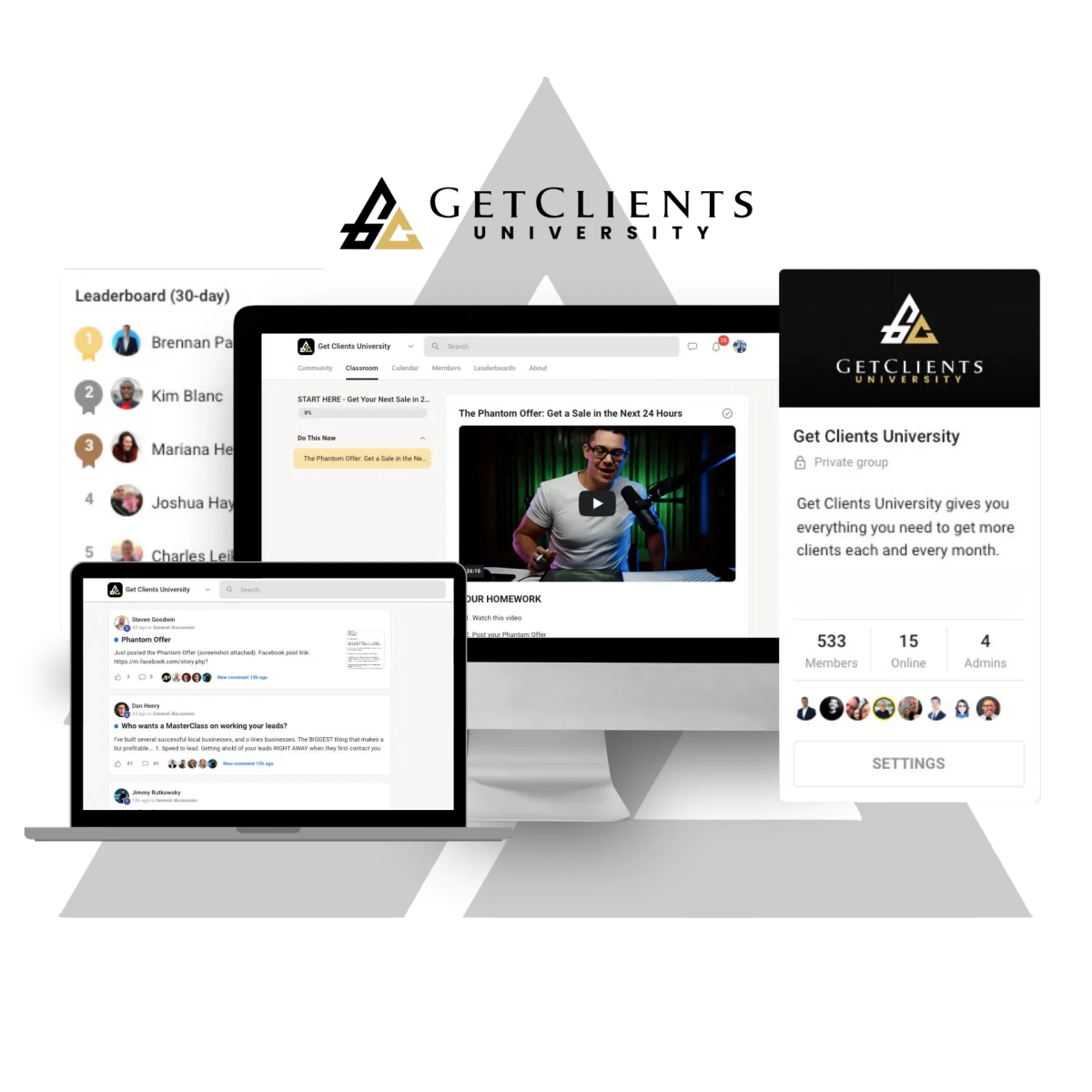

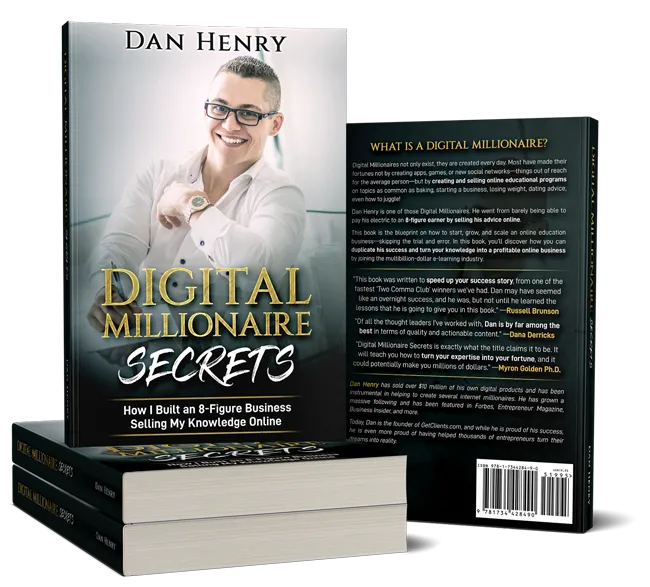

Get Clients University is for online entrepreneurs that want to get more clients and grow a digital business.

Ever heard of Alex Hormozi, Erika Kullberg, Graham Stephan, Alyssa Rimmer, or even yes, Andrew Tate?

These are online entrepreneurs, and yes they make a lot of money.

Believe it or not, back when I was a relative unknown, I was still making great money with a very small audience. I’m still very small compared to these guys, but...

I’ve been in the Internet entrepreneurship space for over 10 years.

I’ve had a lot of wins, many losses, and learned many painful lessons. Being an entrepreneur can be difficult. Every day is an emotional roller coaster of thinking, I’m not good enough. Even to this day.

It's been 10 years of obsession and determination. However, I'm in an insanely better financial situation than I've ever been in my life.

I can tell you, if I knew then what I know now, I would have got here in a fraction of the time.

Years ago, I wanted to be a famous musician...

I spent seven years working at Pizza Hut. I would go home and create songs in my home studio. I hoped one day to make a living from my music and take care of my parents.

But that never happened. I soon realized even if you make it in music, unless you’re Beyoncé, you’re not going to make much cash. So, I had to get serious about making money.

And that’s what led me to a career as a digital entrepreneur. I am obsessed with the art of getting attention online and growing an audience. Then, helping that audience and getting freakin paid for it.

My first digital product took six months to build, and failed miserably.

I was about to give up, but an unforeseen IRS bill (to the sum of $250,000) forced me to test and experiment with every possible method to win at this game.

(I tend to obsess over things I’m not good at.)

To my surprise, my SECOND digital product not only took off but it lasted for four years. It generated millions in revenue.

Since then, my team and I have consistently developed products, services, software and events that have done million in sales. All sold using the good old iNteRnEt.

I’m not saying you’ll make millions. In fact, it takes an obsessive person to make millions with anything. But I’ve also seen a lot of lazy people make a ton of money on the internet.

I’d love to say I learned ALL these “secrets" through some course or guru...

And yes, I learned a TON from my mentors. But ultimately, the majority came from overly obsessive experimentation, millions in ad spend, and thousands of hours of experience.

Blood, sweat, tears, lost friends, sleepless nights, hours of study and dedication to my craft. I love this shit.

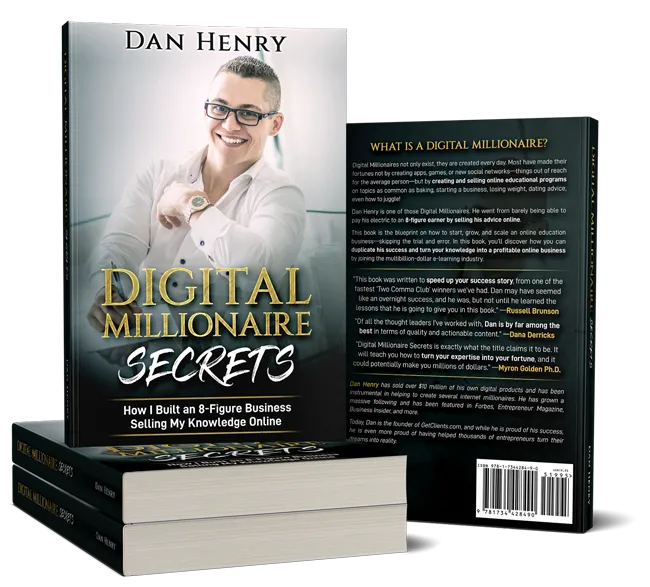

So much, that I even wrote a book on it, and it became a Wall Street Journal and USA Today bestseller.

I've since won almost every award this industry offers, and I’ve personally consulted for over 1,000 online entrepreneurs in my career.

Many of them have become quite successful. Many of them are names you would recognize instantly.

I’ve consulted, in some form or another, folks like Andy Stickel, Laurel Portie, John Whiting, Jason Phillips, and more. Even ole Hormozi asked me to walk him through my video sales system years ago. (man that guy is jacked)

I’ve even hosted events and done stage pitches for big influencers like Russell Brunson and Myron Golden.

Now, I only mention these Devastatingly handsome credentials so you understand you aren't learning from some fly by night guru...

The amount of watered down, butchered, and just senseless information I see out there gives me a real case of the red ass.

Which is why I started Get Clients University.

I felt that most of the information on growing an online business was too complicated, overpriced, or just... shitty.

This is why most people over-think what they do, and then end up doing nothing at all.

This shit can be simple. I promise.

That's why I am so proud that we have grown to 1200 members.

All around the idea that it doesn't need to be so damn complicated.

Whether you are trying to grow, scale, or even if you haven't made a dime, we got you.

Many of our members have grown to six, seven, and even eight figures with their online business.

You'll have access to people that have actually done exactly what you are trying to do.

Here are some of the types of successful online entrepreneurs we have in the community…

Coaches and consultants

Marketing agencies

Online course creators

Video editing agencies

Membership site community owners

Authors and speakers

Affiliate marketers

Software owners

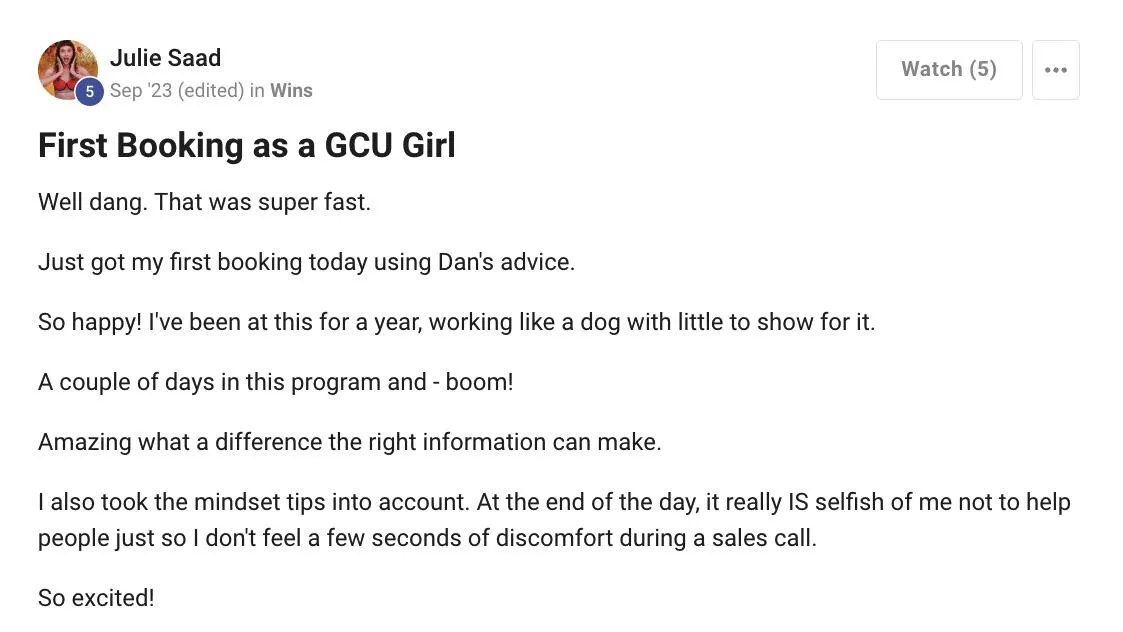

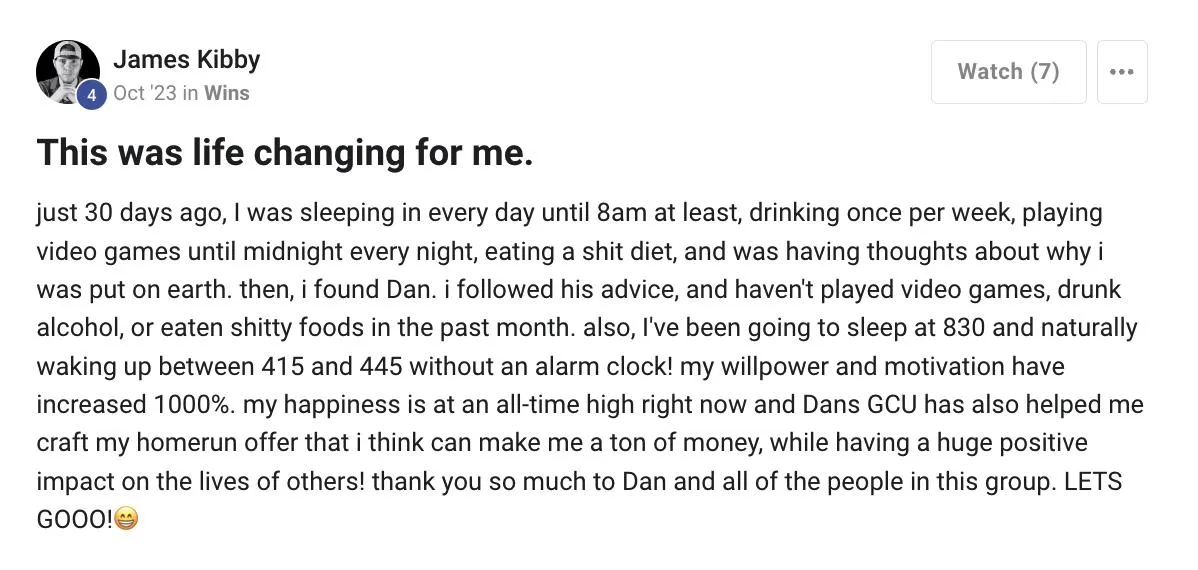

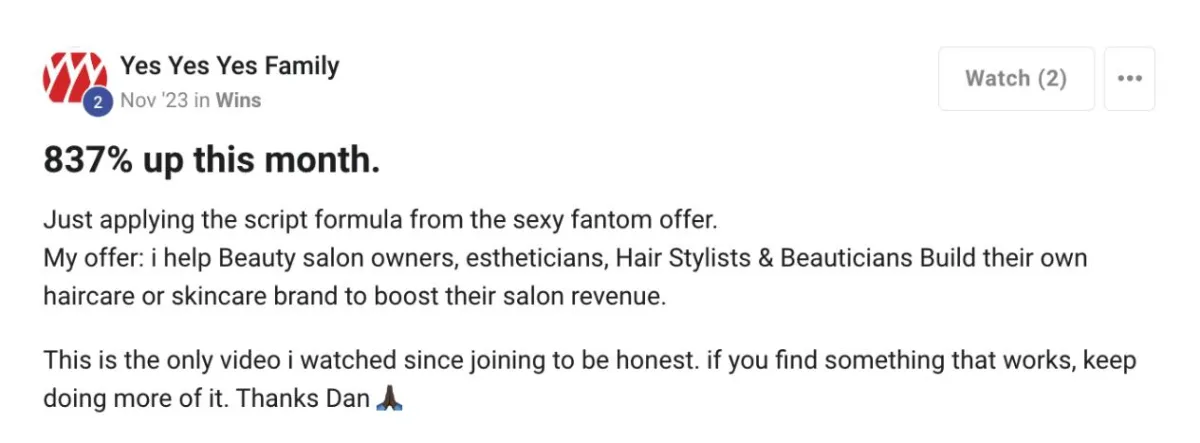

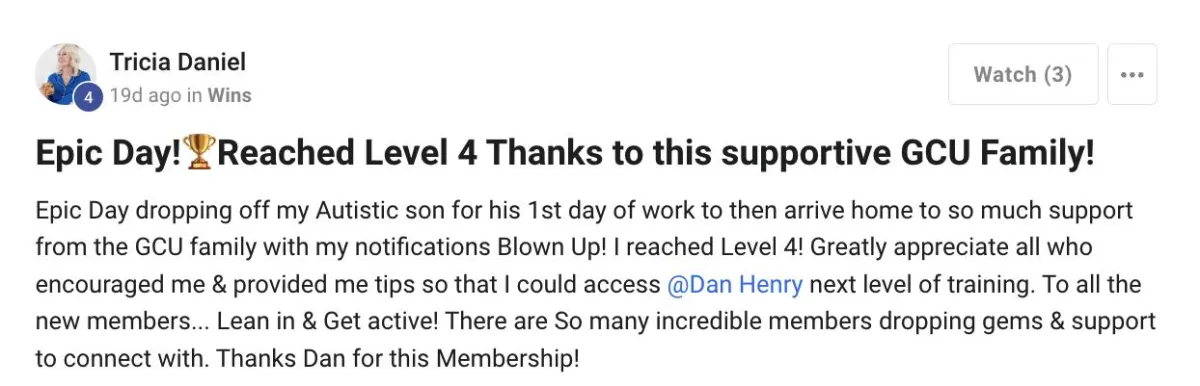

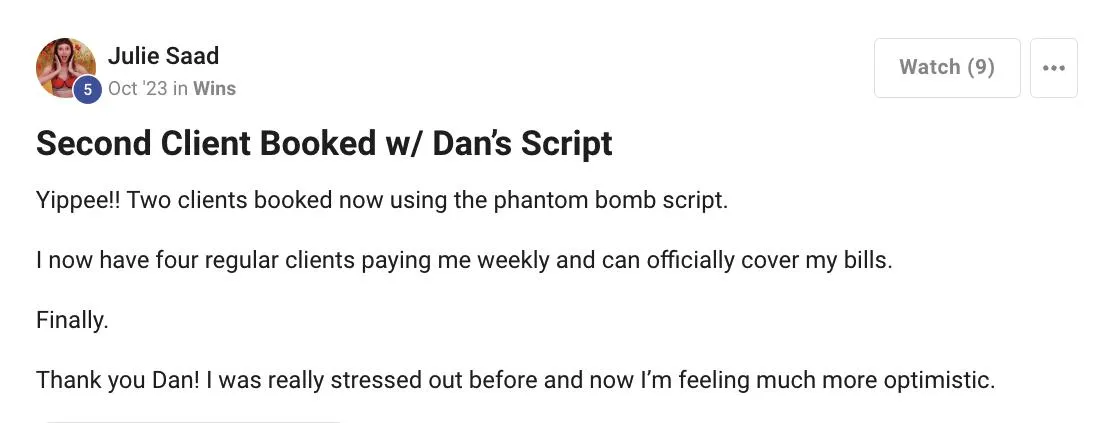

Here are some #wins from our GCU community

Unlike most experts in this space, I don’t focus on teaching some "secret" system that will solve all your problems.

That’s what most people do. The truth is those systems don’t work for everybody. And, when everyone starts using the same thing word for word, they stop working anyway.

I focus on teaching simplicity.

Simple strategies that will work for anyone trying to start or grow an online business. Simple scales.

I know this because I have launched successful online courses, coaching programs, masterminds, memberships, events, software‘s, and even marketing agencies.

And they ALL were successful except ONE. I stuck to my "simple approach" for every one exempt the the one that failed. That one I got fancy. Imagine that.

Footnote: Stick to what works.

I obsess over simplicity and it's something I continue to learn and master every day.

In fact, some days I feel like I know nothing, and always remind myself, I am forever a student.

I Obsessively Over Making this simple for our members.

So many "gurus" overcomplicate things.

Because we combine fundamentals with simplicity, our members can win this game and develop skills that stands the test of time.

It's like having a super power that allows you to build a brand and profitable online business to go with it, for any niche.

Inside GCU, you will develop skills and traits beyond what you could possibly imagine right now.

You will learn to develop a brand that makes people instantly attracted to you.

You will be able to confidently create digital products or services that your audience can’t wait to get their hands on.

You will confidently get new clients with social media content, email marketing, paid ads, and everything in between. You can use these skills to grow your business or help another business.

You will learn valuable life lessons and increase your self worth. You'll become the best version of yourself by immensely raising your value.

You will meet people you would not normally have access to and build a network that builds your net worth.

You will have access to some of the greatest minds in the digital entrepreneurship world.

You will NOT just get followers. The idea is to get followers that pay. We call these people customers.

And then, you’re going to have something that most people don’t.

Options.

You want to create a membership site and make passive income? DONE.

You want to be a coach and get paid thousands per client? DONE.

You want to create a marketing agency and help others grow a business? DONE.

Or maybe, you want to build a brand and get paid to promote other people's products. DONE.

Or maybe you just want to build a brand that allows you to sell multiple things whenever you feel like it. DONE.

All these options can be insanely profitable. They all allow you to make an impact, leave your mark on the world, and change people's lives with your creations.

Whichever you choose, Get Clients University will help you get there.

And with that in mind, here’s what’s included in GCU.

Every month, I’m going to teach you everything I know about growing a digital business...

…ads, branding, marketing, viral marketing, sales, creating offers, scaling offers,, copywriting, up-sells, down-sells, back end, psychology, formulas etc…(This just scratches the surface)

In addition, I'm also going to give you tons of templates, resources, tools, scripts and connections.

Here’s what’s included:

Weekly Training Calls. Every Thursday at 2PM EST (Unless otherwise announced). Call listed below…

Growth Call - One Training Call Per Month with Dan Henry. Every month, I teach one new method of growing your digital business. The call is about 2 hours and I have a Q & A at the end. I sometimes review content, ads, and offers at the end of the call.

Paid Traffic Call - One Training Call Per Month with Hernan Vasquez. Hernan, a top tier media buyer, teaches Facebook and YouTube Ads each month. He also does plenty of Q&A and ad reviews for some members. The call is about 2 hours.

Operations Call - One Training Call Per Month with Joe DiRoma. Every month, Joe, our COO, teaches business operations. He has been the COO for many 8 Figure Brands. (Though, I intend to keep him bwaha). He covers productivity, recruiting, hiring/firing, and systems. The call is about 1 hour and Joe always does Q&A.

Member Spotlight - One Training Call Per Month with a GCU Member that is CRUSHING it. Every month, we bring on a GCU member who has taken the content inside GCU and smashed it. They’ll give you insights into how they used what they learned to get remarkable results. Then, they'll take questions from the community at the end.

Recordings and Replays of All Calls. Watch and rewatch every call as often as you need. You’re getting video recordings, a transcript, and even notes. We take notes so you don’t have to, but you still should.

Training Courses: A collection of my best courses I’ve released over the years. Many of these were over $10,000 when I launched them. Now they are included in GCU.

Courses include: Sold Out Courses, High Ticket Selling, Legendary Productivity, Modern Day Copy, 7 Figure Mindset, Whiteboard Webinar, Youtube Ads for Course, Youtube Ads for High Ticket, Facebook Ads Training, and 30 Day Agency, to name just a few.

Templates, Funnels & Resources: I’m giving you my templates, funnels and resources (including upsells, downsells, emails, scripts, etc…) so you can use them in your own offers.

Community Support. 91% of our members are fully engaged. Our community encourages our members to help each other. Our members get points whenever they post valuable content. The more points you get, the more prizes you unlock. We hold nothing back in GCU. You’re getting advice, mentorship, and insights directly from them every day.

GCU Digest. Every week, you'll receive a PDF newsletter in your inbox. It contains the best GOLD shared in the community that week. You'll never miss anything.

Access to the GCU Private Network. You're going to get access to all the 6-figure, 7-figure, and 8-figure members in the GCU network.

Full Success Roadmap. Once you log in for the first time, we will send you a roadmap. It helps you navigate the entire journey of building your business. You may already be in a certain phase of the roadmap. I recommend you go through the entire thing. This way, you can make sure you don't miss any fundamentals.

So with that in mind, you’re not just going to be learning from me… You’ll be learning from…

Our COO Joe - the man running GetClients.com. He is a C-Suite level player who is master of operations, hiring, recruiting, and helping people perform at the highest level.

Hernan - a 9-figure media buyer. He has managed ads for myself, Frank Kern, AGORA, Jeff Lerner, and others.

Karla - our community manager & offer creation coach who has consulted over 1,200 of our clients, resulting in hundreds of success stories.

Charlene - our pro copywriter that writes all my emails, which produce a major portion of our revenue.

Ivy - our airtable specialist who builds our tracking systems, analyzes data and KPIs, and keeps the company organized.

Plus 1200 rockstars in our group who share absolute GOLD every day.

It’s the full stack of knowledge and skill that you’ve been searching for.

If you want to learn from one of the best online entrepreneurs in the world, reach new heights in your businesses, make insane connections and become a full-stack entrepreneur...

Get Clients University is the first step in your journey toward becoming the 1%.

We’re going to show you everything you need to really understand how the game works at a fundamental level. This way, you’ll know exactly what to do to grow your business with a high degree of certainty.

That’s Get Clients University. So if that’s what you’re for then the last question you have is what is the price & how do you get in...

Here’s the price:

$97/month (you can cancel any time)

How to sign up: (Click The Button Below)

Once you sign up, we will send you an onboarding form.

Fill that out and we will add you to the community. Don’t forget to attend the welcome call as it has amazing insights into how to get the most out of GCU.

PS. Get Clients University is more than a place to learn to make money. It’s a FAMILY of people working hard to help each other in their journey. They aim to make it as SIMPLE and EASY as possible. We take the “overthinking” out of making money.

You will make connections and meet lifelong friends. They could change the entire course of your future. This is the day things turn around for you. You will gain a skill set that will give you everything you need to be successful no matter what the future holds.

Everything You're Going To Get

FULL ACCESS To GCU - ($997 Value)

Monthly "Get Clients Live with Dan" Calls where you'll follow along to get new clients EACH month! ($4,997 Value) Plus recordings of all calls!

Library of super short actionable "get clients" videos. Designed for busy biz owners.

Exclusive networking and support

from fellow GCU members in our community.

Member Workshops. Example: Dan brought on a GCU member who earns $200K/month using a short VSL for a $97 offer via cold FB ads.

Monthly live Q&A sessions with 8-figure digital entrepreneur, Dan Henry.

BONUS 1: 8 Figure Webinar Director's Commentary ($997 Value)

BONUS 2: Micro Book Training

($997 Value)

BONUS 3: Phantom Offer Training ($497 Value)

Hi, I'm Dan Henry

In 2015, after delivering pizza for 7 years, I hit rock bottom and had to sell water bottles to pay my electric bill. I decided enough was enough. So I started researching how to build a profitable online business and get clients. Since then, I’ve:

Sold 8 figures in online consulting & education.

Built and exited a 7-Figure software company

Used the cash flow to build a 7-Figure Real Estate portfolio.

Wrote a WSJ & USA Today bestselling book (Digital Millionaire Secrets).

Became a professional speaker, closed $1 Million in a single day from stage.

Hi, I'm Dan Henry

In 2015, after delivering pizza for 7 years, I hit rock bottom and had to sell water bottles to pay my electric bill. I decided enough was enough. So I started researching how to build a profitable online business and get clients. Since then, I’ve:

Sold $30M in online consulting & education.

Founded and exited a 7-Figure software company

Used the cash flow to build a 7-Figure investment portfolio.

Wrote a WSJ & USA Today bestselling book (Digital Millionaire Secrets).

Became a professional speaker, closed $1 Million in a single day from stage.

P.S. Here's some facts about us and why you should try join GCU...

You’ll be learning from someone who delivered pizza for 7 years and then learned online marketing, which made me a millionaire. Before I had a staff, I had a cheap Asus laptop. I started from the bottom with no powerful friends, no business school and no loans from daddy.

We're always up to date with the latest and greatest strategies, and maintain long term relationships with the best people in the business.

Everything in this training is based on things working right now in 2023. We use this system to enroll 5-10 members per day into Get Clients University at $97/mo. This is UP TO DATE. In fact, I recorded it all in Nov 2023.

We are a legit company. I have written a WSJ & USA Today Bestseller, won many awards in the industry, and have a Youtube channel where I do free business audits and show I know my stuff.

We make an impact on our clients lives. We have worked with over 2,000 clients and tens of thousands of customers. We have over 500 video testimonials.

I’ve speak at some of the top marketing conference in the world. We've been featured in Forbes, Business Insider, Huffpost, and more!

We have spent a LOT of money on Facebook ads, as well as studied viral organic marketing. We geek out on how to grow online. We like to pass what we discover on to our clients.

I also use it to win affiliate contests left and right. Most of which I only send ONE email. So even if you don't have a product, this can work for you. I've won affiliate contests hosted by Russell Brunson, Anthony Morrison, Grant Cardone, Mara Glazer and more!

I'm a leg locking machine but also a proud Father of a future BJJ grappling star.

Get Dan’s Best Selling Book FREE:

Digital Millionaire Secrets: How I Built an 8-Figure Business Selling My Knowledge Online.

Real Client Testimonials

David S. & Abby W.

Abby and I have seen significant improvement in our business performance since working with Dan.

Dan - Honestly, man, this program has been life-changing. Thank you!

Jason P.

My business has grown substantially within just 4-5 months of working with Dan. His guidance has been invaluable.

If you have an opportunity to do anything with Dan, just do it!

Dr. Wasi S.

I've seen a notable increase in my business's performance in the last 10 days. The support from Dan and the community has been fantastic!

Nellie C.

Dan showed me how to raise my prices, and take back my time. I've successfully transitioned to group coaching my recent launch was a success, and I'm excited about the direction we're heading! Thanks Dan!

Marcus C.

The new high-ticket offer is off to a strong start! Thank you Dan Henry! Couldn't have done it without your guidance and system!🙏

John S.

I've closed some of my biggest deals recently, and creating a new VIP offer was a move inspired by Dan's advice.

Thanks Dan for the reminder to give the people what they want!

Nicole B.

After implementing what I've learned from Dan, I've been able to refine my offer and improve its value in the eyes of my clients. This has been a pivotal moment in my business journey!

John W.

Dan's insights have been a crazy valuable as I developed a new offer in the past few months. This experience has contributed to insane growth in my business!.

Jared E.

Transitioning to high-ticket offerings has been a game-changer, attracting better clients and allowing me to focus more on delivering value. Dan's program has truly helped in making my business more fulfilling.

Everything You're Going To Get

FULL ACCESS To GCU - ($997 Value)

Monthly "Get Clients Live with Dan" Calls where you'll follow along to get new clients EACH month! ($4,997 Value) Plus recordings of all calls!

Library of super short actionable "get clients" videos. Designed for busy biz owners.

Exclusive networking and support

from fellow GCU members in our community.

Member Workshops. Example: Dan brought on a GCU member who earns $200K/month using a short VSL for a $97 offer via cold FB ads.

Monthly live Q&A sessions with 8-figure digital entrepreneur, Dan Henry. (This includes some Funnel and Ad reviews!)

BONUS 1: 8 Figure Webinar Director's Commentary ($997 Value)

BONUS 2: Micro Book Training

($997 Value)

BONUS 3: Phantom Offer Training ($497 Value)

Real Client Testimonials

David S. & Abby W.

Abby and I are ending the month at $85k cash collected with 5X ROAS Next up $100k!

Dan - Honestly, man, this program has been life-changing. Thank you!

Jason P.

I went from making $150K a month to $750K a month consistently after working with Dan for just 4-5 months.

If you have an opportunity to do anything with Dan, just do it!

Dr. Wasi S.

$18K closed in last 10 days! 100% organic. Looks like that $50K/month is getting close.

Thank you Dan and the community! 💪🏼❤️😊

Nellie C.

Dan showed me how to raise my prices, and take back my time.

I recently made the switch from one on one coaching to group coaching charging $10K for my offer, and I just sold 42 spots into my coaching program!

Marcus C.

High Ticket with a new offer: $45,000🙏 $35K in Stripe $10K in PayPal.

Now shooting for $100K for September! Thank you Dan Henry! Couldn't have done it without your guidance and system!!!🙏

John S.

Closed a $75k and 50k today. The $75k is a VIP 1 on 1 that I created last week because Dan gave me a nudge.

Thanks Dan Henry for the reminder to give the people what they want.

Nicole B.

I started selling my offer at $297, but after working with Dan and learning to get my clients great results...

I raised my prices to $30K, and I just hit $1M in sales last week!

John W.

In the last 100 days, I’ve built a brand new non-money-making offer and made a total of over $300k cash collected Based on watching and listening to Dan.

I've grossed over 2.5M since working with Dan.

Jared E.

My first 30 days after moving HT crossed $25k. Better clients, less headaches, I can focus more on helping my clients and it's a lot more fulfilling.

Now to make $100k months the norm!